More than $175 billion in U.S. tariff revenue could be subject to refunds after the Supreme Court of the United States on Friday invalidated President Donald Trump’s sweeping emergency tariffs, according to economists with the Penn-Wharton Budget Model.

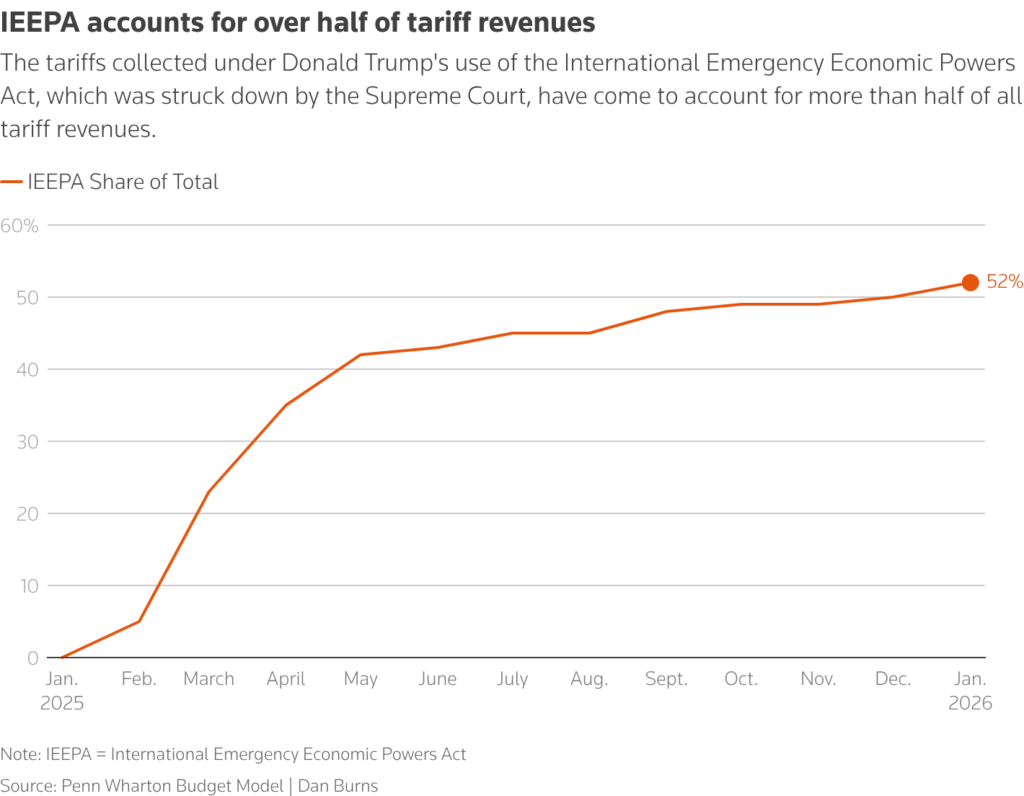

The estimate, prepared at the request of Reuters, was developed using a detailed forecasting model that incorporates tariff rates by product and country for specific duties imposed by Trump, including those authorized under the International Emergency Economic Powers Act (IEEPA), said Lysle Boller, senior economist for the Penn-Wharton Budget Model, a non-partisan fiscal research organization at the University of Pennsylvania.

The Supreme Court dealt Trump a major 6-3 setback, ruling that he exceeded his authority by using IEEPA — a law intended for sanctions — to impose tariffs on imported goods. The justices returned the case to the Court of International Trade to determine next steps, a process expected to trigger a rush of refund claims by companies.

“The Supreme Court did not talk explicitly about the $175 billion in tariffs that could potentially be refunded. On the other hand, their ruling today clearly does open that door for those refunds to be demanded,” Penn-Wharton Budget Model director Kent Smetters told Reuters.

Most companies are expected to pursue refunds, “and it’s basically just going to come out from the U.S. Treasury,” he added.

Trump has frequently highlighted the revenue generated by his tariffs, which the Congressional Budget Office estimated would total about $300 billion annually over the coming decade.

Refunds totaling roughly $175 billion would surpass the combined fiscal 2025 budgets of the Departments of Transportation and Justice.

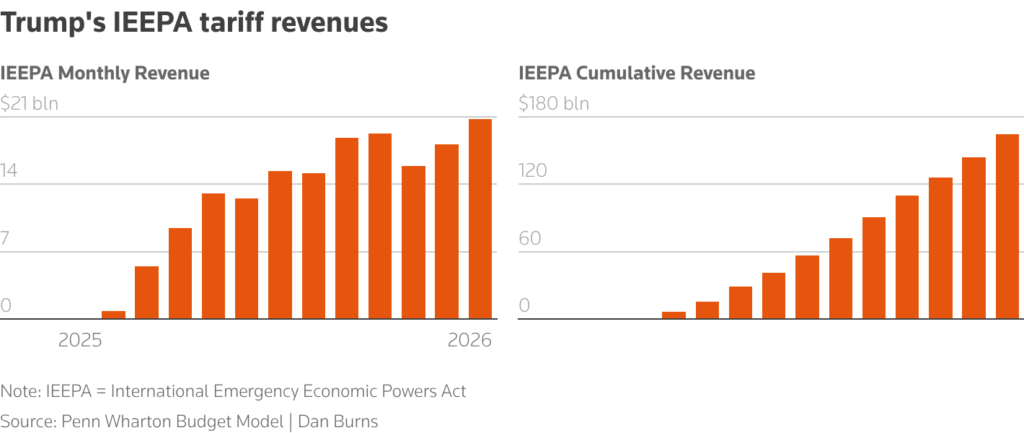

Boller said the Penn-Wharton model — designed for long-term revenue projections — cross-checks United States Census Bureau import data covering roughly 11,000 product categories based on eight-digit tariff classifications across 233 countries. Statistical forecasting methods are then applied, producing an estimate of about $500 million in IEEPA-related tariff revenue collected each day. As of Thursday, the model estimated total receipts of about $179 billion under IEEPA since Trump began imposing tariffs under the law in February 2025.

Penn-Wharton also extrapolated historical customs duty data from U.S. Customs and Border Protection as a share of overall Treasury customs receipts, arriving at a similar estimate between $175 billion and $176 billion, he said.

Customs and Border Protection last published customs assessments for IEEPA-based tariffs and other trade remedies on December 14, showing an at-risk total of $133.5 billion since the first duties were imposed. Net collections are typically somewhat lower because tariff assessments often require adjustments that lead to partial refunds.

The model also incorporates rapid adjustments to reflect sometimes-abrupt tariff changes under Trump, including trade agreements that reduced import duty rates for certain countries. South Korea, for example, saw its U.S. tariff rate fall to 15% from 25% in November.

It also reflects changes in punitive duties imposed under IEEPA, including a 40% tariff introduced last August against Brazil over the prosecution of Trump ally and former President Jair Bolsonaro, as well as the later removal of duties on Brazilian coffee, beef and cocoa in November.

U.S. Treasury Secretary Scott Bessent told Reuters in January that the Treasury would be able to cover any required tariff refunds. Borrowing plans prepared before the Supreme Court ruling called for maintaining large cash reserves — $850 billion at the end of March and $900 billion at the end of June.

Trump moved quickly on Friday to replace the invalidated IEEPA tariffs with a temporary 10% global import duty lasting 150 days, while launching trade investigations under other established laws in order to maintain pressure on trading partners.

Bessent said Friday that the steps would allow the Treasury to keep “virtually unchanged” tariff revenue in 2026.

The Treasury has reported strong increases in customs revenue in recent months, rising by roughly $20 billion per month compared with the previous year before Trump imposed the tariffs, including about $27.7 billion in total customs receipts in January.