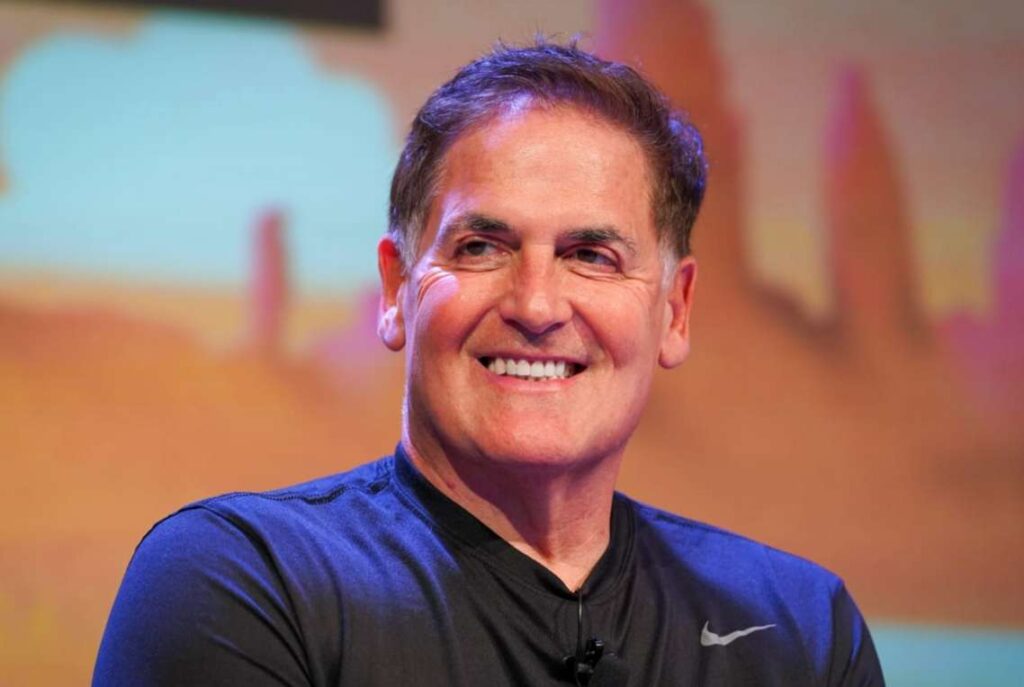

Mark Cuban is turning his fire on the U.S. healthcare industry, arguing that rampant overbilling and deceptive practices by insurers and providers could generate massive federal revenue — if anyone bothered to hold them to account.

“If we fined insurers and providers $100 every time they over-billed, incorrectly denied care or misrepresented any amount of patient out of pocket, we could pay off the national debt,” the billionaire entrepreneur wrote on X last week.

Cuban said the system is stacked against ordinary Americans who are forced to fight through a confusing web of invoices, denials and surprise medical costs. “They play on the fear and information asymmetry that exists in healthcare,” he wrote, urging a sweeping breakup of the biggest players in the industry.

“Break them up. Make them divest non insurance companies,” he said. “And when we are done with the insurance companies, we go to the hospitals and then to the pharma wholesalers. Break em up. Make the markets efficient again.”

If we fined insurers and providers $100 every time they over-billed, incorrectly denied care or misrepresented any amount of patient out of pocket, we could pay of the national debt

— Mark Cuban (@mcuban) December 24, 2025

They play on the fear and information asymmetry that exists in healthcare

Break them up. Make… https://t.co/yc83T2tHs6

Cuban was responding to a post by Scalpel Policy Solutions founder Tanner Aliff, who drew attention to new state laws allowing patients to get “deductible credit” when they pay lower cash prices instead of inflated insurance rates. Aliff said the changes let people save money while still having those payments count toward their yearly deductible.

Aliff explained that rather than “blowing through your entire deductible over a $6,000.00 MRI fee,” patients in some states can now pay roughly $300 in cash for the same scan and still receive deductible credit. He noted that only four states — Texas, Indiana, Tennessee and Oregon — have adopted some form of this policy so far.

Cuban applauded the move and pushed for it to be expanded nationwide. “If cash pay for all [health care] could be counted against your deductible, we all could shop and save money. If your state isn’t on this list, ask your congressman why not,” he said.

Not everyone was convinced the idea would work in the real world. “That you believe that consumers can actually execute this, in a coordinated fashion, makes you delusional,” financial planner Jae Oh shot back. “You have clearly not spoken to real people with any illness. This messaging is doing more harm than good.”

“It happens already. I email and talk to people who buy from Cost Plus all the time,” Cuban replied, referring to his online pharmacy. “I pay deductibles for people all the time. I help people get their [prior authorizations] overturned. All the time. The hardest part is having them count against their deductible.”

With healthcare costs continuing to surge, Cuban and other reform advocates argue that giving patients transparent pricing and fewer barriers could finally bring real accountability to a broken system. Whether more states adopt these policies may end up being a crucial test of how far the movement can go.